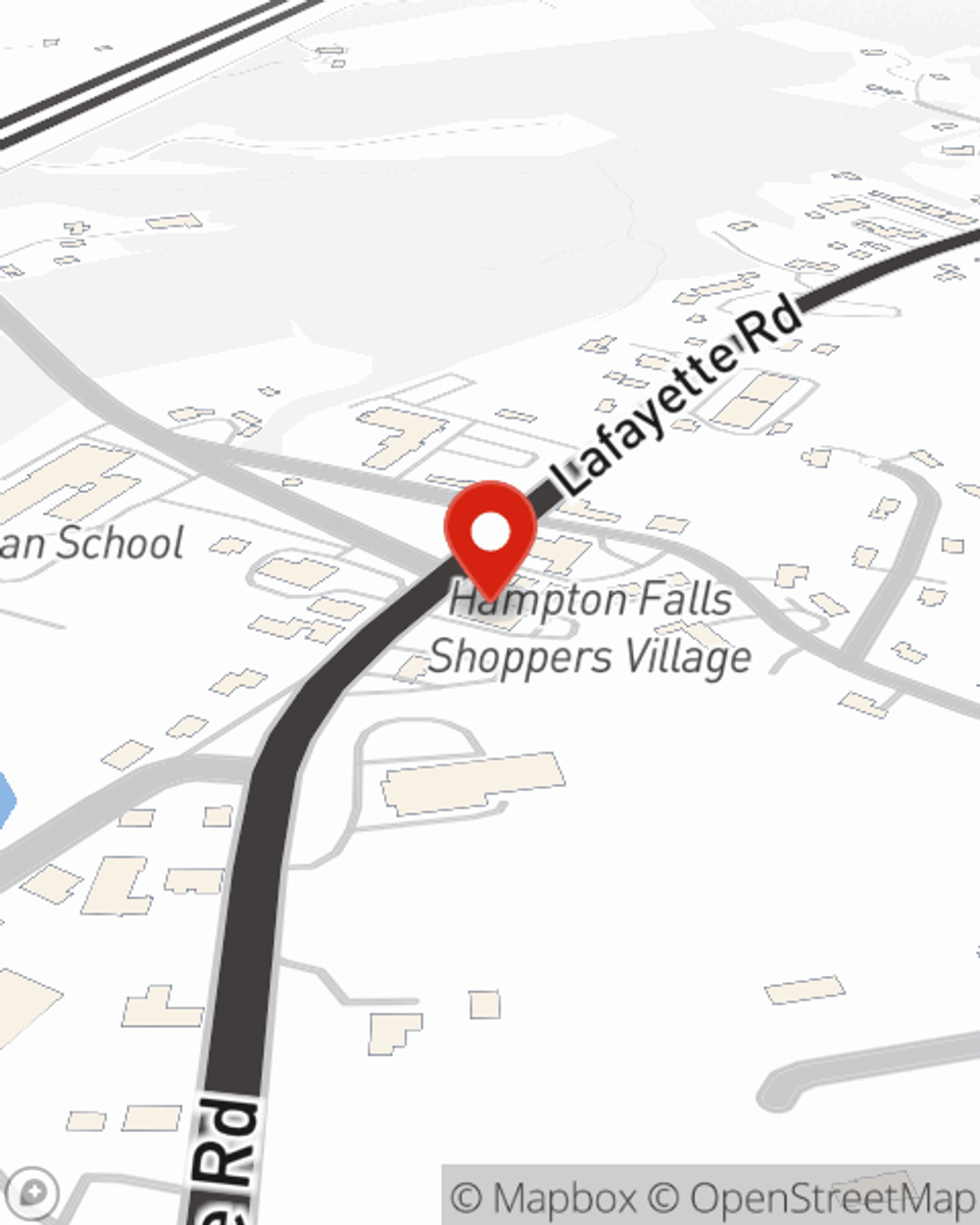

Insurance in and around Hampton Falls

Multiple ways to help keep more of your hard-earned dollars

Cover what's most important

Would you like to create a personalized quote?

A Personal Price Plan® That’s Uniquely You

Your family and your home are some of what's most important to you. It's understandable to want to protect them. That's why State Farm offers great insurance where you can set-up a Personalized Price Plan to help fit your needs.

Multiple ways to help keep more of your hard-earned dollars

Cover what's most important

Insurance Products To Meet Your Ever Changing Needs

But your automobile is just one of the many insurance products where State Farm and Shane St Pierre can help. House, condo, or apartment, if it’s your home, it deserves State Farm protection. And for the unexpected. Securing your family’s financial future can be a major concern. Let us ease that burden. With a range of products, personalized pricing plans, and unmatched financial strength, State Farm Life Insurance is a smart choice and a great value.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Shane St Pierre

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.